Table of Contents

- Introduction

- The Historical Significance of Gold

- Current Trends in Gold Trading

- Technological Advancements and Their Impact

- Economic Factors Influencing Gold Markets

- The Role of Geopolitics in Gold Trading

- Predictions for Gold Trading in the Next Decade

- Investment Strategies for Future Gold Trading

- Conclusion

Introduction

Gold has always been a symbol of wealth and security, transcending cultures and economies throughout history. Its timeless value and stability have not only made it a preferred choice for investors and traders but also a cornerstone in the global financial system. As an asset, gold’s allure lies in its unique properties: it is durable, malleable, and retains its value over time, distinguishing it from other commodities and currencies.

The role of gold in shaping economic landscapes is profound. It has been a standard for currency, a tool for wealth preservation, and a hedge against inflation and currency devaluation. In modern times, this precious metal continues to hold significant importance, especially in turbulent economic climates. The appeal of gold extends beyond mere financial value; it is also a cultural and historical asset, symbolizing prosperity and endurance.

As we look to the future, the trends and predictions in gold trading become increasingly crucial for anyone involved in the market. The evolving dynamics of global economies, technological advancements, and geopolitical shifts are painting a new picture for gold trading. Understanding these changes is essential for investors seeking to navigate this ever-changing landscape. The future of gold trading is not just about the price movements; it’s about comprehending the underlying factors that drive these changes and how they interact with global market sentiments.

In this comprehensive exploration, we delve into the current trends affecting gold trading, the impact of technological advancements, the economic and geopolitical factors at play, and, most importantly, the predictions that shape the future of gold trading. Whether you are a seasoned trader, a new investor, or simply someone interested in the fascinating world of gold, this blog aims to provide valuable insights and strategies to guide your understanding and decisions in the realm of gold trading.

THE HISTORICAL SIGNIFICANCE OF GOLD

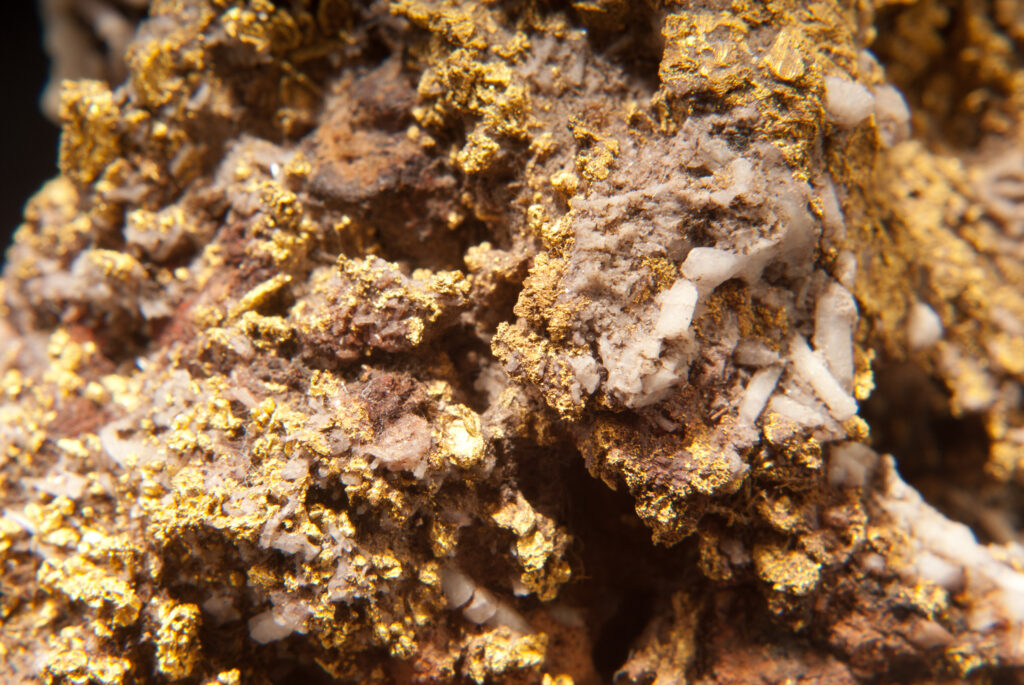

Historically, gold has played a pivotal role in shaping economic systems, cultures, and even political landscapes. This precious metal has been revered and sought after from the earliest civilizations to the present day, symbolizing wealth, power, and beauty.

Ancient Civilizations and Gold

In ancient times, gold was more than just a medium of exchange or a symbol of wealth; it was deeply ingrained in cultures and religions. The Egyptians, for instance, believed gold to be the “flesh of the gods,” and it played a central role in their mythology and pharaonic regalia. Similarly, in ancient Greek and Roman civilizations, gold was used to craft coins, jewelry, and artifacts, symbolizing status and power.

Gold in the Middle Ages

During the Middle Ages, gold continued to be a significant economic driver. The scarcity of gold led to its high value, making it a sought-after commodity for trade and wealth storage. The period also saw the rise of gold-backed currencies, where the value of a coin was directly tied to its gold content, a practice that laid the foundations for modern financial systems.

The Gold Standard Era

The Gold Standard, adopted in the 19th and early 20th centuries by major economies, further cemented gold’s importance. Countries tied their currencies to a specific amount of gold, providing stability and fostering international trade. This era witnessed significant economic growth and stability, largely attributed to the reliability of gold as a backing for currencies.

Gold in Modern Economies

In contemporary times, while the Gold Standard is no longer in use, gold’s significance remains undiminished. It acts as a hedge against inflation and a safe haven in times of economic uncertainty. Its demand is not just limited to the financial sector; industries such as electronics, dentistry, and aerospace extensively use gold for its conductive and corrosion-resistant properties.

Gold’s Cultural and Symbolic Value

Beyond its economic and industrial uses, gold holds a profound cultural and symbolic value across different societies. It represents purity, prosperity, and success, often used in cultural ceremonies and as a gift to mark significant life events.

In summary, the historical significance of gold is multifaceted, spanning economic, cultural, and technological realms. Its consistent demand, coupled with limited supply, has ensured that gold remains a unique and valuable asset in the global market, transcending time and cultural boundaries.

CURRENT TRENDS IN GOLD TRADING

In recent years, the landscape of gold trading has undergone significant transformations. These changes are not just reshaping how gold is traded but also influencing the broader perception and value of gold in the global market.

DIGITAL REVOLUTION IN GOLD TRADING

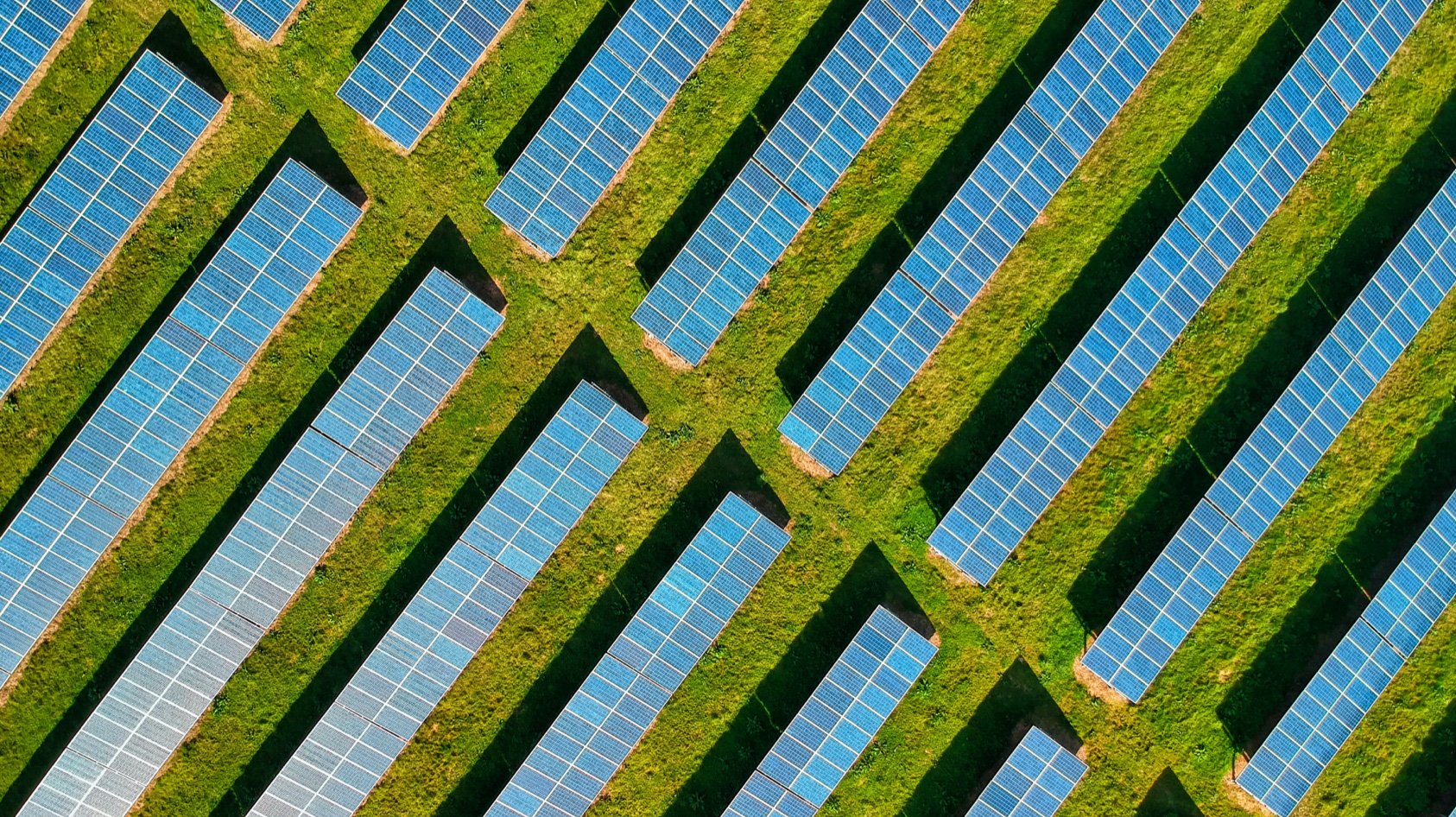

The rise of digital trading platforms has revolutionized gold trading, making it more accessible and transparent. These platforms offer real-time pricing, global market access, and the ability to trade small quantities, democratizing gold investments. The introduction of digital gold tokens and gold-backed cryptocurrencies is further blurring the lines between traditional gold investing and the digital economy. This digital shift is attracting a younger, tech-savvy generation of investors, broadening the market base for gold.

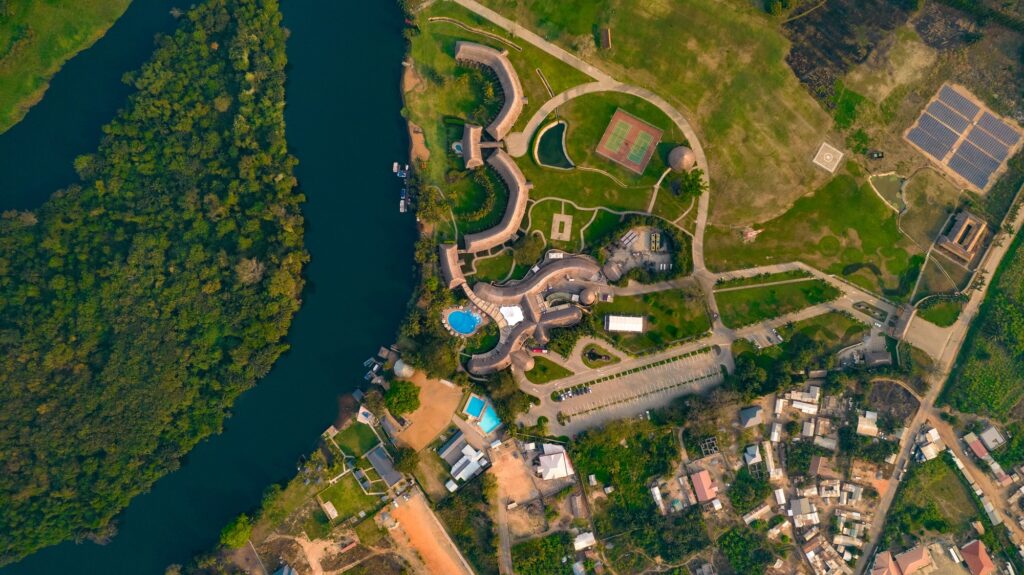

ETHICAL SOURCING AND SUSTAINABILITY

Another significant trend in gold trading is the increasing emphasis on ethical sourcing and sustainability. There’s a growing awareness among consumers and investors about the environmental and social impacts of gold mining. As a response, many companies and trading platforms are implementing strict sourcing policies, ensuring that the gold they trade comes from responsible sources. This shift towards ethical sourcing is not only a moral imperative but also a response to market demand, as more investors seek to align their portfolios with their values.

THE IMPACT OF ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) CRITERIA

Environmental, Social, and Governance (ESG) criteria are becoming increasingly important in the gold trading sector. Investors are scrutinizing the ESG performance of mining companies, looking at how they manage environmental impacts, ensure worker safety, and uphold governance standards. Gold mining companies that excel in these areas are often more attractive to investors, reflecting a broader trend towards responsible investing.

GOLD RECYCLING AND CIRCULAR ECONOMY

The concept of a circular economy is gaining traction in the gold industry. Gold recycling, which involves recovering gold from electronic waste, old jewelry, and other sources, is becoming an integral part of the gold supply chain. Recycling not only reduces the environmental impact of gold mining but also ensures a more sustainable and ethical source of gold. This trend is likely to grow as technology for gold recycling becomes more advanced and cost-effective.

THE ROLE OF CENTRAL BANKS

Central banks play a crucial role in the gold market, and their activities are closely watched by traders. In times of economic uncertainty, central banks often increase their gold reserves, boosting confidence in gold as a safe-haven asset. The buying and selling decisions of these institutions can significantly impact gold prices and market dynamics.

The current trends in gold trading are characterized by technological innovation, ethical and sustainable practices, and a shift towards responsible investing. These trends are not only reshaping the gold market but also setting the stage for its future evolution.

TECHNOLOGICAL ADVANCEMENTS AND THEIR IMPACT

The gold trading industry is at the forefront of a technological revolution, leveraging cutting-edge innovations to streamline processes, enhance security, and provide better insights for decision-making.

BLOCKCHAIN TECHNOLOGY IN GOLD TRADING

Blockchain technology is playing a pivotal role in transforming gold trading. Known for its decentralized and tamper-proof ledger, blockchain provides unmatched transparency and security in transactions. This technology is particularly beneficial for tracking the provenance of gold, ensuring that every piece traded is ethically sourced and complies with regulatory standards. Furthermore, blockchain enables the creation of gold-backed digital tokens, allowing for seamless trading and ownership transfer without the physical movement of gold. This development is particularly appealing to a new generation of traders who value the efficiency and immediacy that digital tokens provide.

AI AND MACHINE LEARNING IN MARKET ANALYSIS

Artificial Intelligence (AI) and Machine Learning (ML) are significantly impacting the way market analysis is conducted in gold trading. By processing vast amounts of data, these technologies can identify patterns and trends that might be invisible to the human eye. AI-driven predictive analysis helps traders make more informed decisions by providing insights into market movements, potential risks, and opportunities. This technology is also being used to develop advanced trading algorithms that can execute trades at optimal times, maximizing profits and minimizing losses.

BIG DATA IN GOLD MARKET RESEARCH

The use of Big Data in gold trading cannot be overstated. The ability to analyze large datasets – ranging from historical pricing data to global economic indicators – provides traders with a comprehensive view of the market. Big Data analytics help in understanding the multifaceted influences on gold prices, including geopolitical events, currency fluctuations, and economic policies. This holistic approach to market research is essential for developing robust trading strategies.

INTERNET OF THINGS (IOT) AND GOLD SUPPLY CHAIN MANAGEMENT

The Internet of Things (IoT) is beginning to find its application in the gold trading industry, particularly in supply chain management. IoT devices can track the movement of gold from mines to markets, ensuring the integrity and security of the supply chain. This technology aids in verifying the authenticity of gold products and provides end-to-end visibility, which is crucial for maintaining trust in the trading process.

VIRTUAL AND AUGMENTED REALITY IN GOLD TRADING

Emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) are starting to make their way into gold trading. These technologies can provide immersive experiences for clients, such as virtual tours of gold mines or interactive visualizations of gold products. While still in the early stages of adoption, VR and AR have the potential to transform the way gold is marketed and sold, offering unique and engaging experiences for investors and traders.

In summary, technological advancements are profoundly influencing gold trading, offering new opportunities and capabilities. From blockchain’s security to AI’s predictive power, these technologies are setting the stage for a more efficient, transparent, and innovative gold trading landscape.

ECONOMIC FACTORS INFLUENCING GOLD MARKETS

The gold market is intricately tied to the broader global economy. Understanding the impact of various economic factors on gold prices is essential for traders and investors. Here, we dive deeper into the key economic elements that play a pivotal role in shaping the gold market.

ECONOMIC STABILITY AND ITS INFLUENCE ON GOLD

Economic stability, or the lack thereof, can significantly influence gold prices. In stable economic times, gold prices tend to be less volatile, as investors opt for higher-yielding assets. However, during periods of economic instability, such as recessions or financial crises, gold’s appeal as a safe-haven asset increases. Investors flock to gold as a way to preserve their wealth, leading to a surge in demand and consequently, an increase in its price. Thus, monitoring global economic indicators and trends can provide valuable insights into potential movements in the gold market.

THE ROLE OF INTEREST RATES IN GOLD TRADING

Interest rates set by central banks have a profound effect on gold prices. Higher interest rates generally result in a stronger currency, making gold more expensive for holders of other currencies. This can lead to a decrease in gold demand and a drop in its price. Conversely, lower interest rates can weaken a currency and make gold more affordable, boosting its demand. Additionally, lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it a more attractive investment.

INFLATION AND ITS CORRELATION WITH GOLD

Gold is often considered a hedge against inflation. As inflation erodes the value of paper currencies, gold’s value tends to rise. This is because gold is priced in currency units, and as the purchasing power of the currency decreases, it takes more units of currency to buy the same amount of gold. Inflationary periods, therefore, often see an increase in gold prices. Investors and traders should pay close attention to inflation rates and forecasts as part of their market analysis.

THE IMPACT OF CURRENCY FLUCTUATIONS

The strength of the dollar, in particular, has a significant impact on gold prices. Gold is predominantly traded in U.S. dollars, so a stronger dollar can make gold more expensive for investors using other currencies, reducing demand. On the other hand, a weaker dollar can make gold cheaper and more attractive for foreign investors, increasing demand and driving up prices. Tracking the performance of the dollar against a basket of major currencies can provide insights into potential trends in the gold market.

GLOBAL TRADE DYNAMICS AND GOLD

Global trade dynamics, including trade agreements, tariffs, and disputes, can also impact gold prices. For instance, trade tensions can create uncertainty in global markets, prompting investors to seek the safety of gold. Conversely, positive developments in global trade can lead to a boost in economic confidence, potentially reducing gold’s allure.

A multitude of economic factors plays a critical role in the gold trading market. By closely monitoring these elements, investors and traders can gain a better understanding of the market dynamics and make more informed decisions.

THE ROLE OF GEOPOLITICS IN GOLD TRADING

Geopolitics plays a crucial and often dramatic role in the gold market, as political stability and international relations can have a profound impact on gold prices. This section explores the various geopolitical factors that influence gold trading.

GEOPOLITICAL TENSIONS AND THEIR IMPACT ON GOLD

Geopolitical tensions, such as conflicts, wars, and political unrest in key regions, can lead to a surge in gold prices. During times of geopolitical instability, gold is often sought after as a safe-haven asset. Investors and traders flock to gold to safeguard their investments against potential losses in other markets. For example, historical instances like the Gulf Wars or tensions in the Korean Peninsula have seen significant spikes in gold prices.

THE EFFECT OF TRADE POLICIES AND SANCTIONS

Trade policies and sanctions imposed by major economies can also influence the gold market. Sanctions against gold-producing countries can disrupt the supply chain, leading to a decrease in gold supply and an increase in prices. On the other hand, favorable trade policies or the lifting of sanctions can lead to increased market stability and a potential decrease in gold prices. Monitoring international trade agreements and sanctions is thus vital for understanding potential market shifts.

THE INFLUENCE OF GLOBAL ECONOMIC POLICIES

Economic policies enacted by major economic powers, such as the United States, China, and the European Union, can have far-reaching effects on the gold market. Policies that affect global economic stability, such as monetary policy decisions by central banks or fiscal stimulus measures, can either increase or decrease the attractiveness of gold as an investment. For instance, expansionary monetary policies, like quantitative easing, can lead to lower interest rates and a weaker currency, making gold a more attractive investment.

POLITICAL ELECTIONS AND REGIME CHANGES

Political elections and changes in government can bring about uncertainty in the markets, often leading to increased demand for gold. The anticipation of policy changes, especially in major economies, can cause investors to hedge their bets by investing in gold. The outcomes of these political events can either reinforce or diminish this trend, depending on the perceived stability and economic policies of the new leadership.

GLOBAL SUMMITS AND INTERNATIONAL RELATIONS

International summits and the state of international relations can also play a role in gold trading. Summits like the G7, G20, or meetings of the World Trade Organization can lead to agreements or disputes that impact global economic stability. Positive outcomes from these summits can lead to a reduction in gold prices, while unresolved conflicts or escalations can increase gold’s appeal as a safe haven.

The intricate interplay of geopolitical events and policies is a critical factor in the gold trading market. Staying informed about global political developments is essential for traders and investors to anticipate and react to potential market fluctuations.

PREDICTIONS FOR GOLD TRADING IN THE NEXT DECADE

The future of gold trading holds several exciting prospects. By analyzing current trends and market dynamics, we can make informed predictions about what the next decade may hold for gold trading.

INCREASED DEMAND IN EMERGING MARKETS

The demand for gold in emerging markets is expected to grow significantly in the coming years. This growth can be attributed to several factors:

- Economic Growth: As emerging economies continue to develop, their financial markets will expand, leading to increased investment in gold.

- Wealth Accumulation: Rising incomes in these regions may lead to higher savings rates, and gold is often seen as a stable investment.

- Cultural Factors: In many emerging markets, gold holds significant cultural value, often used in jewelry and as gifts during festivals and weddings. As disposable incomes rise, so does the demand for gold in these forms.

- Diversification of Reserves: Central banks in emerging economies are likely to continue diversifying their reserves by adding gold, further driving up demand.

TECHNOLOGICAL INTEGRATION AND MARKET EFFICIENCY

Technological advancements are poised to make gold trading more efficient and accessible:

- Digital Platforms and Apps: The development of user-friendly digital platforms and mobile apps will make gold trading more accessible to a broader audience, including retail investors.

- Blockchain and Tokenization: The use of blockchain for tokenizing gold assets will offer greater transparency, security, and ease of trading, potentially attracting a new demographic of tech-savvy investors.

- AI and Data Analytics: Advanced analytics and AI-driven tools will provide traders with more accurate market predictions and insights, allowing for smarter investment decisions.

PRICE VOLATILITY AND ITS IMPLICATIONS

Price volatility in the gold market is expected to increase, influenced by various factors:

- Geopolitical Uncertainty: Ongoing geopolitical tensions and conflicts can create market uncertainties, leading to fluctuating gold prices.

- Economic Policies: Changes in global economic policies, especially by major economies like the USA and China, can significantly impact gold prices. Policies affecting interest rates, inflation, and currency values will be key factors to watch.

- Global Health and Environmental Crises: Events like pandemics or environmental disasters can lead to sudden shifts in market sentiment, affecting gold prices.

- Investment Trends: The increasing trend of using gold as a hedging instrument against market uncertainties and inflation will contribute to its price volatility.

The next decade in gold trading is likely to be marked by increased demand, especially from emerging markets, enhanced by technological advancements, and characterized by greater price volatility. Understanding these trends and preparing for them will be crucial for traders and investors looking to capitalize on the opportunities in the gold market.

Investment Strategies for Future Gold Trading

Diversifying Portfolios with Gold

Including gold in a diversified investment portfolio is a time-tested strategy for risk mitigation. Here’s how investors can effectively integrate gold into their portfolios:

- Asset Allocation: Depending on risk appetite, investors can allocate a certain percentage of their portfolio to gold. A common approach is to hold 5-10% in gold assets, balancing the portfolio against market volatility.

- Types of Gold Investments: Diversification can be achieved through different types of gold investments, such as physical gold (coins, bars), gold ETFs (Exchange-Traded Funds), gold mining stocks, and gold mutual funds. Each type has its own risk and return profile, suiting different investment strategies.

- Rebalancing: Regularly rebalancing the portfolio is crucial to maintain the desired level of exposure to gold. This involves buying or selling gold assets as market conditions change and other assets in the portfolio appreciate or depreciate in value.

Staying Informed: Economic and Political Developments

Staying informed about global economic and political developments is essential for successful gold trading. Investors can adopt these practices:

- Following Market News: Regularly follow financial news from reliable sources to stay updated on economic trends, interest rate decisions, inflation rates, and geopolitical events.

- Economic Indicators: Pay attention to key economic indicators such as GDP growth rates, unemployment rates, and manufacturing indexes, as they can significantly impact gold prices.

- Political Events: Keep an eye on global political events, including elections, policy changes, and international relations, as they can create uncertainties or stability in the markets, affecting gold prices.

Leveraging Technology for Gold Trading

Utilizing advanced technology can significantly enhance gold trading strategies:

- Trading Platforms: Choose a trading platform that offers robust tools for market analysis, real-time data, and seamless execution of trades.

- Analytics and Forecasting Tools: Use analytics tools that leverage AI and machine learning to predict market trends and offer insights for informed decision-making.

- Mobile Apps and Alerts: Take advantage of mobile apps that provide real-time alerts on gold price movements, economic news, and market analysis, allowing traders to make timely decisions.

Risk Management Techniques

Effective risk management is crucial in gold trading. Here are some techniques:

- Stop-Loss Orders: Set stop-loss orders to limit potential losses on gold trades.

- Hedging: Consider hedging strategies, like options and futures, to protect against adverse price movements.

- Diverse Investment Vehicles: Diversify within gold investments themselves, spreading risk across physical gold, stocks, ETFs, and other derivatives.

Long-term vs. Short-term Trading

Understand the difference between long-term and short-term gold trading strategies:

- Long-term Investing: Focuses on holding gold assets for an extended period, benefiting from potential long-term price appreciation and hedging against inflation.

- Short-term Trading: Involves actively buying and selling gold or related securities to capitalize on short-term market fluctuations. This requires a good understanding of market analysis and a higher tolerance for risk.

A combination of portfolio diversification, staying informed, leveraging technology, employing risk management techniques, and understanding the nuances of long-term versus short-term trading will be key to navigating the future gold market successfully.

What did we learn?

As we look ahead, the future of gold trading is shaping up to be dynamic, multifaceted, and full of potential. The trends and predictions we have explored paint a picture of a market that is evolving rapidly, influenced by a complex interplay of technological, economic, and geopolitical factors. For traders and investors, this environment presents both challenges and opportunities.

Embracing Change and Innovation

Adapting to the changing landscape of gold trading will be crucial. Embracing technological innovations, understanding the nuances of the digital gold market, and staying abreast of developments in blockchain and AI will provide traders with new tools and opportunities. These advancements are not just changing the way gold is traded; they’re redefining the very nature of the market.

Strategic Planning and Adaptability

Success in future gold trading will require strategic planning and adaptability. Investors and traders must be prepared to adjust their strategies in response to global economic shifts, geopolitical events, and market trends. This will involve a continuous process of learning, analysis, and adaptation.

Ethical and Sustainable Investing

The growing focus on ethical sourcing and sustainability in gold trading cannot be ignored. Aligning investment strategies with these values will not only be a moral choice but also a strategic one, as the market increasingly favors ethically sourced and sustainable gold. This shift represents a broader trend in investing, where social and environmental considerations are becoming as important as financial returns.

Navigating Volatility with Informed Decision-Making

The anticipated increase in market volatility underscores the need for informed decision-making. Traders and investors who can effectively navigate these fluctuations, armed with comprehensive market analysis and insights, are likely to find success. This involves not only understanding the gold market itself but also the broader economic and political contexts that influence it.

Long-Term Perspective

Finally, maintaining a long-term perspective will be key. While short-term fluctuations will provide opportunities for agile traders, the true value of gold as a stable, enduring asset should not be overlooked. For those looking to preserve wealth or hedge against uncertainty, gold remains a cornerstone investment.

The future of gold trading is bright with potential, but it requires a keen understanding of the market’s evolving dynamics. By staying informed, embracing technology, planning strategically, and considering ethical implications, traders and investors can position themselves to thrive in this exciting and ever-changing market.

“For over 120 years, we have been at the forefront of steel industry innovation. Today, our dedication lies in spearheading the path to a sustainable future for steel and steel manufacturing. Together, we forge a greener and more sustainable tomorrow.”